Strategic Acquisitions. Sustainable Growth.

01

What We Do

RRNW Group specializes in acquiring middle market businesses & commercial real estate with a proven track record of success and significant growth potential.

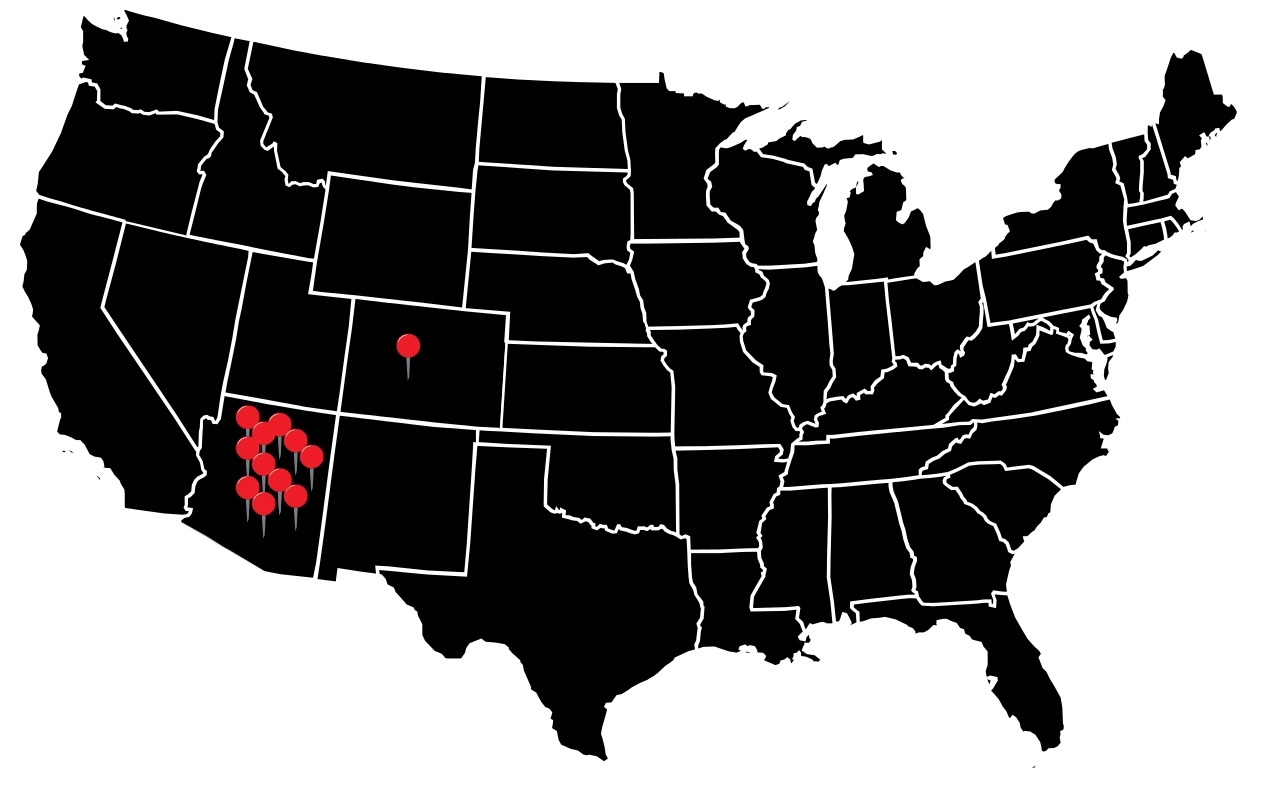

Our current portfolio consists of profitable businesses and over 1,400,000 square feet of retail space in Phoenix, Arizona valued at more than $200 million USD. We are actively advancing development projects across Arizona and have recently expanded into Colorado, adding retail assets with a combined value of $140 million USD. We are looking to expand into Texas in Q4-2025.

02

Our Approach

We seek cash-flowing businesses and commercial real estate assets with strong foundations and growth potential, including those that may benefit from recapitalization. We focus on companies with experienced and capable management teams to ensure a seamless transition and operational continuity. Our goal is to drive sustainable growth by leveraging our expertise and resources while preserving the legacy and values of the assets we acquire.

03

Our Mission

RRNW Group is actively seeking to acquire two to three well-established businesses per year with a minimum EBITDA of $2 million, as well as income-producing commercial real estate assets with strong growth potential. Our strategy involves utilizing a combination of personal and partner funds to finance acquisitions, ensuring a streamlined process without the need for an external equity raise. This approach reflects our commitment to maintaining control, aligning interests with our partners, and fostering sustainable, long-term growth across the businesses and properties we acquire.

04

Our Fund

Big Ben Private Real Estate Fund I is a private real estate investment fund. Launched in 2023 with a capital raise of $50 million USD, the fund was established with a focused mandate to invest in value-add retail properties across high-growth markets. To date, the fund is 100% deployed, with investments spanning a diverse portfolio of retail assets that offer strong cash flow and upside through active management, redevelopment, and strategic leasing initiatives. Big Ben Private Real Estate Fund II ($50 million USD) launches Q4-2025 to target select opportunities that align with its disciplined investment strategy, leveraging deep market knowledge and operational expertise to drive value and deliver strong, risk-adjusted returns for its partners.

About

About RRNW Group

RRNW Group kicked off during the 2008 housing market crash, snapping up over 500 multi-family units in Florida. After selling those properties, we ventured into Western Canada, picking up more than 200 units before selling them in 2022. Now, we’re concentrating on commercial real estate in Arizona, having acquired over 1.4 million square feet of retail space across Arizona and Colorado. Moving forward, we’re doubling down on expanding our Arizona holdings, branching out into Texas, and diversifying by acquiring cash-generating businesses in Ontario and Arizona to fuel growth and create lasting value.

Business Targets

Location: Ontario or Arizona

Purchase Price: $7MM to $30MM

EBITDA: $2MM +

* No oil and gas (no commodities)

Real Estate Targets

Location: Arizona, Colorado, Texas & Ontario

Purchase Price: $10MM to $250MM

Target Cap Rate: 6-7%

* Retail, Office, Industrial, Mixed-use, Multi-family

Stats

Portfolio By the Numbers

RRNW Group’s current portfolio is a mix of commercial real estate and businesses.

Assets

Sq Feet of Real Estate

Portfolio Value

Portfolio Age

Retail

Commercial Retail Assets

We have over 1.4 million square feet of commercial retail.

Offices

Toronto & Saskatoon (Canada)

Arizona, Colorado, Texas (USA)

Contact

Josh Adman (Portfolio Manager)

Josh@RRNWgroup.com

Office Hours

Mon-Fri: 9am – 9pm EDT

Sat-Sun: Closed